Our Story

Hello, and welcome to Fat Tail Investment Research.

I’m James Woodburn,

the publisher.

|

Our goal is simple: to show you stuff about investing and wealth protection that the mainstream is NOT showing you.

And, in doing so, make your life better.

We are a marketplace of ideas.

Our editors and researchers look for great ideas…ideas that stand the test of time.

It’s stupid to follow the mainstream blindly. But, equally, it is also stupid to be contrarian for the sake of it.

‘Buy when blood is running in the streets’, is the ancient Rothschild advice. We would add yes, that’s a good idea. Just make sure it’s not your blood…

We explore honest ideas about your money. Why? Because it’s those ideas that are most valuable.

I’ll explain.

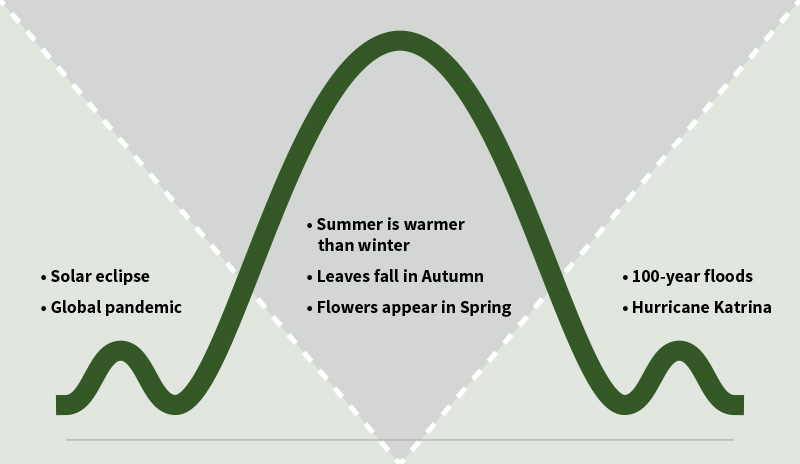

You can look at the distribution of events — in the markets and in life — as a bell curve (like this one below).

The most likely to happen events bunch in the middle (the mean).

But it’s a fascinating world we live in…

When scientists looked at phenomena ‘randomly’ distributed according to a regular bell-curve pattern, they noticed something…

Out at the ends of the curve, where the rare events are registered, they found small bumps and bulges.

They found that things that are not expected to happen often actually occur more often than they had thought.

‘Hundred-year floods’, for example, happen every 80 or so years. ‘Once-in-a-lifetime’ solar eclipses occur every 18 months.

Statisticians refer to these bulges on the extremities of bell-shaped curves as ‘fat tails’.

Instead of tailing off as they are supposed to, the rare events seem to swell up.

Where you don’t expect them.

Our business investigates these events for you

We’re looking at the bell-curve phenomenon in humans. Particularly as it relates to your wealth and your investments.

We tend to underappreciate the extremes. And we tend to exaggerate the ordinary. We see today and guess that tomorrow will be just the same. It probably will be, but there is always a chance that it will be different. And this chance is greater than anyone thinks.

If you had asked a group of investors in August 1929 what was likely to happen on Wall Street, you’d have heard a range of views too. You might even have found a ‘crank’ or two who predicted a market crash.

But the majority view was nothing like what happened.

Most people thought stock prices would hold steady or go up. Few anticipated ‘Black Monday’, with its 30% break in prices. It turned out the cranks were right.

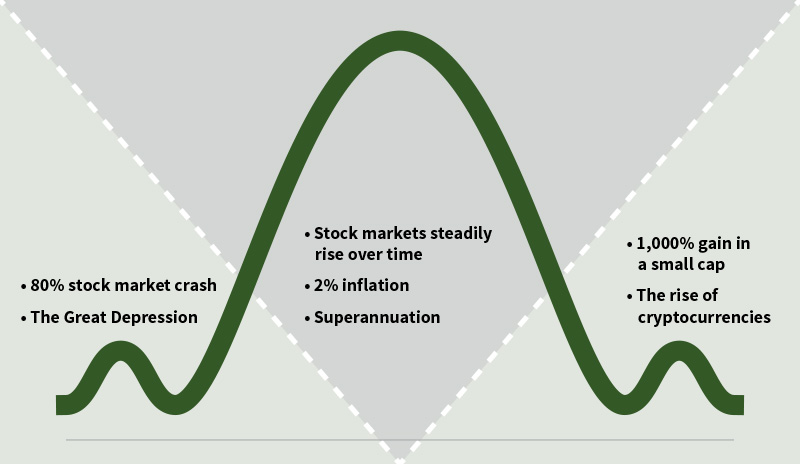

Similarly, you can also use the bell curve to describe the financial industry in Australia.

On this bell curve is all the investment advice and ideas peddled by the mainstream financial media and advisors.

These, too, are in the centre of the bell curve. They are ideas most know about, events that most people expect, and investments that most people believe to be the best way to grow or protect wealth.

But the wacky-sounding, edgy, slightly less reputable, but much more valuable ideas are on either side of the fat middle ground, as you can see:

Our primary focus is to explore these ‘fat tail’ ideas and events, anticipate them and recommend ways for you to invest around them.

Whether it’s a small-cap with a world-changing new technology few have heard about…or a macro position that few have interpreted yet…or the chameleon world of cryptocurrencies — which seems completely crazy but also part of our future…

If you can get ahead of these events…before they march towards the middle…it can have a profound impact on your wealth and financial security.

And that’s really what separates us from other investment advisers or publishers of financial research here in Australia.

Mainstream advisors and financial media are safe. They HAVE to stay safely in the middle of the bell curve.

We don’t. We explore possible events from the tail end of the curve. And when we find something worthy of your attention, we tell you in no uncertain terms what we believe it means.

That is our point of difference.

Our name — Fat Tail Investment Research — embodies that.

We believe that gives you three important key benefits and advantages…

Better information.

The best type of information to have is what’s both new and not widely understood.

Superior knowledge.

Mainstream media is mostly comforting. It tells you what you already know. It doesn’t challenge you. It doesn’t worry you or excite you. And it’s supported in large part by advertisers who are trying to sell you products. But we are not beholden to outside advertisers. We only write about our own ideas.

True wisdom.

You will never make money buying what everybody else already thinks is the next ‘sure thing’. That’s because mainstream financial ideas are already well known and fully priced in. Only fringe ideas — those that are out there on the fat tails, not yet picked up by the mainstream or accepted — have the greater potential to pay off.

All new financial and investment ideas and trends start on the fat tails of the bell curve. That’s where innovation takes place. That’s where future opportunities come from. And where systemic risks first show up.

My final point is on the philosophy that underpins the daily work we do here.

It’s a philosophy instilled into our business by our founder more than 15 years ago.

In his words:

‘Money is not wealth. Money is a means to an end. That end is whatever you choose it to be. But the way you get there is with better research. That leads to better investing. Better investing leads to financial independence. And financial independence allows you to live a better, richer, and freer life.’

If that sounds good to you, then have a look around. Check out our various specialised advisories. If you haven’t already, sign up for one of our free daily newsletters.

I hope this is the beginning of a long and prosperous relationship.

Sincerely,

James Woodburn,

Publisher, Fat Tail Investment Research

Our People

Join Our Team

If you're looking for a new opportunity to grow your career, get in touch with us now. Send us a copy of your CV/resume, and a cover letter explaining why you're a perfect fit for Fat Tail Investment Research.